Duped investors facing $1-billion loss after forex website disappears overnight

Contents

Now that we’ve covered some popular forex strategies, some crucial fundamentals must be kept in mind. First and foremost, don’t get too caught up in short-term movements. It’s easy to get caught up in the market’s day-to-day fluctuations, but remember that these aren’t necessarily indicative of the long-term trend. Instead, focus on the overall picture and make decisions accordingly. Look for currency pairs that are breaking out of long-term consolidation patterns.

When you trade forex pairs, you are presented with a ‘buy’ price that is often above the market price and a ‘sell’ price that is often below the market price. The difference between these two prices is referred to as the ‘bid-ask’, or ‘buy-sell’ spread. Retail traders account for a much lower volume of forex transactions in comparison to banks and organisations. Using both technical analysis and fundamental analysis, retail traders aim to profit from forex market fluctuations. The foreign exchange market is used primarily by central banks, retail banks, corporations and retail traders. Understanding how each of these players interact with the FX market can help to determine market trends as part of your fundamental analysis.

Introduction To Futures Trading

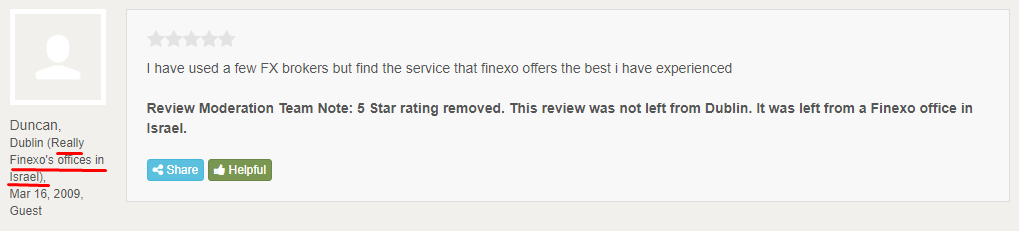

Reading reviews of forex brokers will help you determine whether a company is regulated, if you are unable to find the information yourself. Moreover, by using an ECN broker, traders usually trade in a more efficient and transparent environment. Forex trading doesn’t take place on a regulated exchange , as it occurs between buyers and sellers from anywhere in the world, through an over-the-counter market. Metatrader 4 is the preferred platform of advanced traders due to the sheer amount of information displayed in one window.

Accepting those losses while gaining more experience about trading is an important part of every trader’s journey. Unlike other markets, forex trading doesn’t have to stop when the sun goes down. Since forex is traded all over the world, trading markets are open 24 hours a day, 5 days a week, so you can trade when it is convenient for you.

Protect your profits against foreign exchange risk, without locking up your capital, with EDC’s FXG.

Both technical and fundamental analysis have pros and cons, but trend-following strategies can be successful using either approach – or a combination of both. The Bladerunner Forex Strategy is based on a simple concept – price action. This means that when using this strategy, you will look at charts and make decisions based on what you see happening with the price. This strategy can be profitable if the carry is positive, meaning that the interest rate on the currency bought is higher than on the currency sold. The profit from the carry trade can be reinvested to compound returns. When choosing your platform for social trading, pay attention to the following points to find the best provider.

The “Ask” price — the higher price in the quote —is the price at which you can buy a currency pair. The “Bid” price — the lower price in the quote —is the price at which you can sell a currency pair. Note that most major currency exchange rates are quoted to five decimal places. One exception among the major global currencies involve the Japanese yen, for which exchange rates are quoted to three decimal places. From there, you can delve into technical indicators to supplement your economic analysis.

Trade our full suite of markets like FX, indices, shares and commodities our flagship trading platforms designed for serious traders. The potential for gains is enhanced if the currency you’re betting against falls in value. On the downside, you will magnify your losses if easymarkets review the currency you traded against value increases. As you can see, your risk of losing is multiplied when you employ a leveraging strategy because you are investing money you don’t actually own. A country’s underlying economic performance can affect the price of its dollar.

By investing in a variety of different currencies, you can minimize your risk and maximize your profit potential. One of the great things about MACD is that it can be used in any time frame. That means you can use it on your daily chart to find long-term trends or on your 1-hour chart to find short-term trends. MACD is not perfect, but it helps you spot trends as they form and gives you an early indication of when the market might reverse, making it easier to take a position in the direction of the trend. It does not require complex analysis or guesswork; instead, it relies on clear signals from indicators to generate profits consistently.

This flow of money across international markets generates a huge and growing forex trading turnover. For 2019, the global daily forex turnover is estimated at $6.6 trillion, which makes forex the largest and most liquid financial market in the world. And, although trade flows comprise a significant proportion of the daily turnover in the forex market, an even larger proportion is accounted for by cross-border capital flows.

For example, wikifolio has tried to provide an extremely balanced search function that makes it possible for the customer to find the right top trader based on a wide variety of parameters. However, it is considered clear among experts that such a conclusion is inadmissible, especially when trading speculative products. Quite a few experts also see this type of social trading as a form of gambling. Even with the amount of the actual risk, some platforms deal rather marginally and, above all, put the enormous chances of winning in the foreground.

And you may also have received a message on LinkedIn or Instagram from a stranger asking if you know about forex and how much money you could make from it. Forexmentor.com’s objective is to provide you with the best and most honest training experience possible. We won’t lie to you about how easy Forex trading is and how you will get rich overnight trading the Forex. Customer service that is responsive and upfront is a sign of a good broker.

There are some people who trade in the Forex market because they see it as a form of gambling and betting on the winning number. And there are others who trade Forex just for the personal satisfaction of making a trading system work for them and coming out with the results they aimed for. We are always satisfied when we make the right choice and come home the winner. This introduction to Forex trading is the first lesson in our FXAcademy tutorial. Throughout our online courses, we will be teaching all about Forex trading, which has become a very popular money-making vehicle.

What is Foreign Exchange?

For instance, with the 100x leverage, you can buy 1 lot of EUR/USD worth 100,000 euro by depositing only 1,000 euro in equity. If you want to be optimally mobile, then you can also use easyMarkets App available on Android and iOS; download lexatrade it on your phone and you can trade forex on the go. MT4 is usually preferred by people that have access to a computer, either desktop or laptop. EasyMarkets platform on the other hand is both intuitive and powerful, and online.

- Another benefit of accessing real quotes is that you avoid “re-quotes”, which can have a negative impact on your overall trading performance.

- The top 5% of forex traders have a profitable trading system that generates consistently accurate trading signals for them, while the bottom 95% of traders do not have such a system.

- Jaron Mark, a medical resident at a hospital in Tampa, Florida, says he spent nine months seeking a safe investment before he chose Secure.

- The details of daily trading results, the pitches in the videos and the testimonials won him over.

- This is a fact, but if you know what you are doing you will be able to consistently pull money out of this market.

Fortunately, some of the differences between successful traders and those who lose money are no longer a secret. Through conducting an intense study of client behaviour, the team at Friedberg Direct has identified three areas where winning traders excel. While there is no “holy grail” for profitable forex trading, establishing good habits in regards to risk vs reward, leverage and timing is a great way to enhance your performance. Flexibility and diversity are perhaps the two biggest advantages to trading forex. The ability to open either a long or short position in the world’s leading major, minor or exotic currencies affords traders countless strategic options.

A CFD is a highly popular financial instrument designed specifically for day trading. A CFD is a derivative product, where two parties agree to pay each other the difference in price of an underlying asset, between the time of purchase and sale open and close) of the position. Diversification will help you to avoid disastrous outcomes for your trading account. A perfect example would be trading in USD/CHF in January of 2015, when its price dropped approx.

Derivative trading can provide opportunities to trade forex with leverage. There are a many ways to trade on the forex market, all of which follow the previously mentioned principle of simultaneously buying and selling currencies. If you believe an FX ‘base currency’ will rise relative to the price of the ‘counter currency’, you may wish to ‘go long’ that currency pair.

Experienced forex traders usually take advantage of forex market volatility to earn huge amount of profits. One of the main reason why forex trading popularity is increasing by the day is because it gives traders a chance to trade both during the day and night, 5 days a week. This means that traders have the flexibility to trade at their most convenient bitbuy review time. The fact that it is open 24 hours means that you can do other important things when the markets are not so active then get back to business during peak trading hours. The fact that the forex market is global means that the market will always be open 24 hours. This is a very lucrative feature that has attracted many people to forex trading.

Forex margin is a good-faith deposit made by the trader to the broker. It is the portion of the trading account allocated to servicing open positions in one or more currencies. Margin is a vital component to forex trading as it gives participants an ability to control positions much larger than their capital reserves. We offer a collection of robust software suites, each with unique features and functionalities. Trading Station furnishes traders with the utmost in trade execution, technical analysis and accessibility. No matter what your approach to forex trading may be, rest assured that Friedberg Direct has your trading needs covered.

What is ECN Trading and What are its Advantages?

Forex trading is a popular form of investment, but it’s not for everyone. Investors looking for the best forex trading strategies will often find that what works for others may not work for them. A promoter typically advertises a special “RRSP loan.” They say it lets you get around the tax laws and tap into your locked-in funds. To get the loan, you have to sell the investments you now hold in your locked-in retirement account , then use the money to buy shares of a start-up company the promoter is selling.

in the Forex market?

A brochure describing the nature and limits of coverage is available upon request or at If you are interested in boosting your forex IQ, completing a multi-faceted forex training course is one way to get the job done. To learn more, check out our currency market primer to get on the same page as the forex pros. To ensure that you have your best chance at forex success, it is imperative that your on-the-job training never stops.

When trading forex, leverage allows traders to control a larger exposure with less of their own funds. The difference between the total trade value and the trader’s margin requirement is usually ‘borrowed’ from the forex broker. Traders can usually get more leverage on forex than other financial instruments, meaning they can control a larger sum of money with a smaller deposit.

How to Trade Forex in Canada

In the meantime, a whole series of different providers with a specific orientation has established themselves. We explain what is important when choosing the right provider and what should also be considered in relation to social trading. The reverse holds true if you are purchasing products in a foreign currency, with the risk that you will have to pay more. Foreign exchange risk management is how you can get protection against exchange rate fluctuations. I have been trading the Forex market for years & also have been teaching Forex trading for years!